The Ultimate Legal Checklist for International Residents in Ibiza

Wealth Management

Making a life in Ibiza is a significant personal decision. All too often, we see new residents focusing on the excitement of the destination, only to be faced with legal complexities later on. This guide stems from our core mission of transforming a daunting list of requirements into a clear path forward.

Table Of Contents

The Ultimate Legal Checklist for International Residents in Ibiza

Legal Checklist for International Residents in Ibiza is not just another bureaucratic to-do list, it is the foundation for living on the island without surprises.

Many newcomers assume that moving to Ibiza is the same as moving anywhere else in Spain, but the island operates with its own legal nuances and local rules.

From property ownership to tax compliance, understanding these specifics from the outset transforms what could be a series of setbacks into a smooth and confident transition.

Securing Your Foundations: Your Legal Checklist for Property

Your home is your anchor on the island, so ensuring its legal security is essential.

The process begins with obtaining a NIE (Foreigners’ Identification Number), which is necessary for any important procedures, such as opening a bank account or buying property.

Once you have found your ideal home and are ready to buy, it is essential to carry out due diligence.

This is where your lawyer acts as an investigator, verifying the property and any debts on the property in the Land Registry through a Nota Simple, checking that the property has the necessary permits, and ensuring that the purchase agreement unequivocally protects your interests.

A recurring problem is incomplete documentation, especially with regard to rural or rezoned land.

A house with stunning views may not be properly registered in the Land Registry, or it may have building restrictions that you will only discover when you go to sell the property.

Once you own a property, you need to be aware of your ongoing obligations:

These include IBI (annual property tax), garbage collection fees, and community fees…

For non-residents, another common oversight is the non-resident income tax, which must be paid even if the property is empty.

Skipping it doesn’t go unnoticed, Spain’s tax authorities are increasingly proactive.

Legal Checklist for International Residents in Ibiza: Tax and Compliance

Imagine an international resident who has purchased a beautiful villa in Ibiza.

They spend long, blissful summers on the island, easily surpassing the 183-day mark, but their business and primary income remain in their home country.

They diligently pay their annual Non-Resident Income Tax for the property, assuming they’ve fulfilled all their obligations.

Two years later, a formal notification arrives from the Agencia Tributaria (the Spanish Tax Agency). Spanish tax authorities, have reclassified them as a Spanish tax resident for those years based on their time spent on the island.

Suddenly, they are facing a demand for Spanish income tax on their worldwide income, plus steep penalties and late-payment interest.

Their income from abroad is now retrospectively subject to the Spanish system, a situation they never anticipated and which carries significant financial consequences.

This scenario is common and entirely avoidable. The core issue is the critical misunderstanding of tax residency.

An initial analysis of your situation determines your residency status and establishes the correct, most efficient way to structure your tax affairs from day one, ensuring there are no costly surprises from the Agencia Tributaria.

Your Long-Term Legal Strategy

Initial setup is just the beginning.

As your life and the law evolve, true peace of mind comes from proactive, ongoing legal support. This is the role of a Legal Manager for your affairs in Ibiza.

It signifies a shift from simply completing a checklist to implementing a long-term strategy: continuously optimizing your tax position, managing your assets efficiently, and ensuring your legal structure adapts to your changing life.

It is the ultimate step in securing your long-term interests on the island.

Why Ibiza is not ‘Spain in general’

Living in Ibiza means navigating a legal landscape with its own distinct challenges, ones that often catch international residents off guard.

- Urban planning and rural land: Many properties, especially those with “dream views,” sit on protected rustic land. Extensions or renovations may require permits that are far stricter than on the mainland. Non-compliance can lead to stop-work orders and significant fines.

- Tourism and property use: Unlike other regions, Ibiza enforces particularly tight controls on tourist rentals and property licenses. Even minor misuse can result in sanctions or limit your ability to monetize your property.

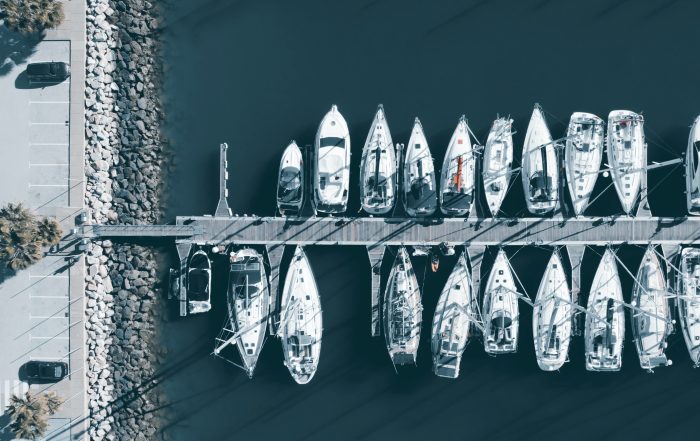

- Maritime and yachting compliance: Ibiza’s popularity as a yachting hub has brought increased oversight. Charter operations require not only licenses but also compliance with mooring regulations and local maritime checks. Missing one detail, such as proof of an operational base, can trigger penalties.

Recognizing these Ibiza-specific realities ensures that your legal strategy is not just Spanish, but truly local.

FAQs: Legal Checklist for International Residents in Ibiza

Do I need a NIE even if I only plan to manage day-to-day matters?

Yes. From opening a bank account to signing utility contracts, the NIE is essential for almost any formal step in Spain.

What if I spend several months in Ibiza but keep my business abroad?

If you exceed 183 days in a calendar year, you may be considered a Spanish tax resident and liable for worldwide income taxation. A tailored tax strategy from the outset avoids unexpected liabilities.

Are informal agreements with builders or service providers reliable?

No. Without a written, detailed contract, disputes over costs or deadlines are extremely difficult to defend under Spanish law. Always formalize agreements in writing, ideally bilingual.

Which ongoing taxes should property owners expect?

IBI (annual property tax), garbage collection fees, and community charges are standard. For non-residents, Non-Resident Income Tax also applies, even if the property is unused.

How do I know a property is free of hidden issues?

A Nota Simple reveals ownership and debts, but further due diligence is critical for Ibiza: confirming planning legality, building permits, and compliance with rural land restrictions.

What’s the safest way to avoid hidden liabilities in contracts?

Request a bilingual contract and have it reviewed before signing. Spanish clauses are legally binding, even if you did not fully understand them.

Navigating Ibiza’s legal landscape may feel complex at first, but understanding these essentials transforms uncertainty into confidence.

Each step you take today, clarifying ownership, taxes, and compliance, lays the foundation for a life on the island that’s secure, enjoyable, and fully yours

Discover all our services and contact our experts now. Follow us on Linkedin to make sure you don’t miss a thing.